|

|

REPORT BY: URGC Ambassador Dr. Leonie Constantinou

BRICS - DOES THE EU & UN FUNDING HAVE ANYTHING TO WORRY ABOUT?

Does the EU have anything to worry about?

YES..... I BELIEVE IT DOES.......

The European Central Bank (ECB) has several far-reaching challenges expected to emerge in 2015.

The greatest challenge remains deflation, which at 0.3 per cent threatens growth in the 18-nation Eurozone.

Falling global oil prices – Brent crude fell to $57 a barrel this week, a 40 per cent drop since June 2014 – threaten to push deflation even further in 2015.

First off, production and transportation prices of foodstuffs, for example, fall proportionally with declining oil prices.

The ability to pay wages weakens as does the ability to pay loans and other debts.

Asset valuation, such as in the real estate/property sector, decreases and investors (as, too, prospective buyers will likely curb spending) are discouraged from pouring money into industry or the stock markets because deflation signals lower-than-normal returns.

If oil prices remain below $60 a barrel for the next year, normally robust economies such as the UK and Switzerland, in addition to France and Italy, will likely face deflation during the course of 2015

Crisis in Greece … again

A renewed political crisis stemming from the Greek Prime Minister’s failed third attempt on Monday to get his choice of president approved by parliament also threatens to plunge the Eurozone further into financial dire straits.

The whole political crisis puts in the balance ECB bailout packages for the Greek financial system, which in 2009 nearly fell apart on defaulted loans and threatened the Euro currency itself.

The Greek economy began to unravel in 2009 when the government announced it could not meet its huge debt due to massive overspending.

Its budget deficit began to surge shortly after government financed the 2004 Athens Olympics.

The debt crisis was further exacerbated when the global economic crisis hit and the government feared defaulting on its loans. It had no choice but to seek help from the EU and the IMF.

Although the EU and IMF agreed to a total of over $300 billion in bailout loans, they demanded that the Greek government take severe measures to cut spending.

Athens agreed but this measure was met with millions of Greeks taking to the streets in protest sometimes with violence reported between demonstrators and police.

Greece’s economy has been in recession since the global economic crisis hit. However, if it is unable to show growth in the next two years, it is likely Athens will be unable to pay any debt to its foreign lenders, ultimately forcing it to leave the Eurozone, where Greece will be forced to restructure and it is highly feasible to say it will be greatly attracted to the new to be BRICS world bank which many nations are now attracted to including UK

For the past two years, Greece’s parliament has authorized austerity measures including increased income tax on middle and high-income earners, self-employed and businesses, and also the cutting of a slew of benefits.

It is unknown at this point whether a new parliament will agree to use Greek assets as collateral, as agreed with the ECB since the crisis.

ECB harmony?

Rifts within the Central Bank are also threatening consensus on stimulus programs as early as the first quarter of 2015.

So, what is expected? It is now obvious that many global Government tactics which determine the common folk of this world, future, have become evident to us all. The weakening of the mighty Dollar can have a devastating effects upon many global economies as well as well as weakening of diplomatic influences which can cause instability as well as lack of funding to meet the present world crisis of over 50 million global refugees who desperately need assistance as well as many other countries who rely upon support from the USA

BRICS - DOES THE EU & UN FUNDING HAVE ANYTHING TO WORRY ABOUT?

Does the EU have anything to worry about?

YES..... I BELIEVE IT DOES.......

The European Central Bank (ECB) has several far-reaching challenges expected to emerge in 2015.

The greatest challenge remains deflation, which at 0.3 per cent threatens growth in the 18-nation Eurozone.

Falling global oil prices – Brent crude fell to $57 a barrel this week, a 40 per cent drop since June 2014 – threaten to push deflation even further in 2015.

First off, production and transportation prices of foodstuffs, for example, fall proportionally with declining oil prices.

The ability to pay wages weakens as does the ability to pay loans and other debts.

Asset valuation, such as in the real estate/property sector, decreases and investors (as, too, prospective buyers will likely curb spending) are discouraged from pouring money into industry or the stock markets because deflation signals lower-than-normal returns.

If oil prices remain below $60 a barrel for the next year, normally robust economies such as the UK and Switzerland, in addition to France and Italy, will likely face deflation during the course of 2015

Crisis in Greece … again

A renewed political crisis stemming from the Greek Prime Minister’s failed third attempt on Monday to get his choice of president approved by parliament also threatens to plunge the Eurozone further into financial dire straits.

The whole political crisis puts in the balance ECB bailout packages for the Greek financial system, which in 2009 nearly fell apart on defaulted loans and threatened the Euro currency itself.

The Greek economy began to unravel in 2009 when the government announced it could not meet its huge debt due to massive overspending.

Its budget deficit began to surge shortly after government financed the 2004 Athens Olympics.

The debt crisis was further exacerbated when the global economic crisis hit and the government feared defaulting on its loans. It had no choice but to seek help from the EU and the IMF.

Although the EU and IMF agreed to a total of over $300 billion in bailout loans, they demanded that the Greek government take severe measures to cut spending.

Athens agreed but this measure was met with millions of Greeks taking to the streets in protest sometimes with violence reported between demonstrators and police.

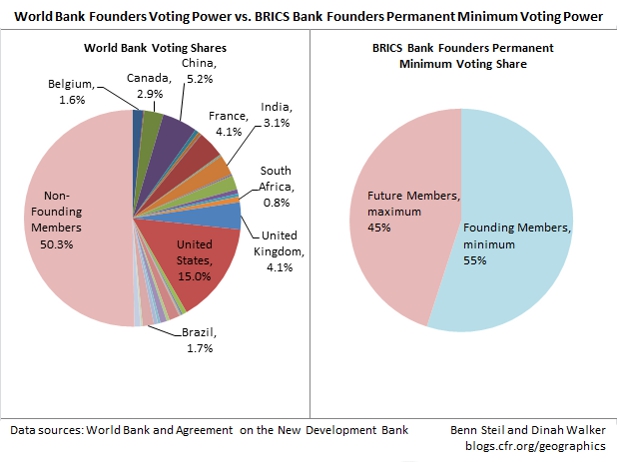

Greece’s economy has been in recession since the global economic crisis hit. However, if it is unable to show growth in the next two years, it is likely Athens will be unable to pay any debt to its foreign lenders, ultimately forcing it to leave the Eurozone, where Greece will be forced to restructure and it is highly feasible to say it will be greatly attracted to the new to be BRICS world bank which many nations are now attracted to including UK

For the past two years, Greece’s parliament has authorized austerity measures including increased income tax on middle and high-income earners, self-employed and businesses, and also the cutting of a slew of benefits.

It is unknown at this point whether a new parliament will agree to use Greek assets as collateral, as agreed with the ECB since the crisis.

ECB harmony?

Rifts within the Central Bank are also threatening consensus on stimulus programs as early as the first quarter of 2015.

So, what is expected? It is now obvious that many global Government tactics which determine the common folk of this world, future, have become evident to us all. The weakening of the mighty Dollar can have a devastating effects upon many global economies as well as well as weakening of diplomatic influences which can cause instability as well as lack of funding to meet the present world crisis of over 50 million global refugees who desperately need assistance as well as many other countries who rely upon support from the USA

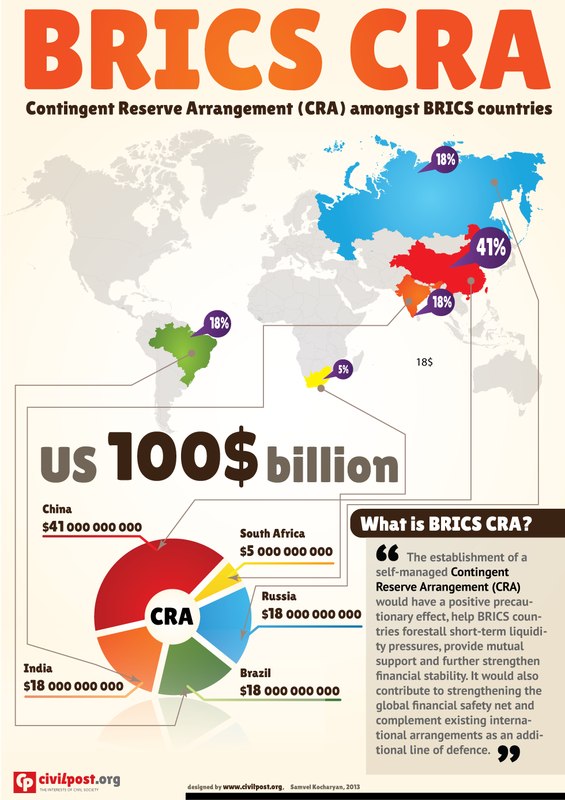

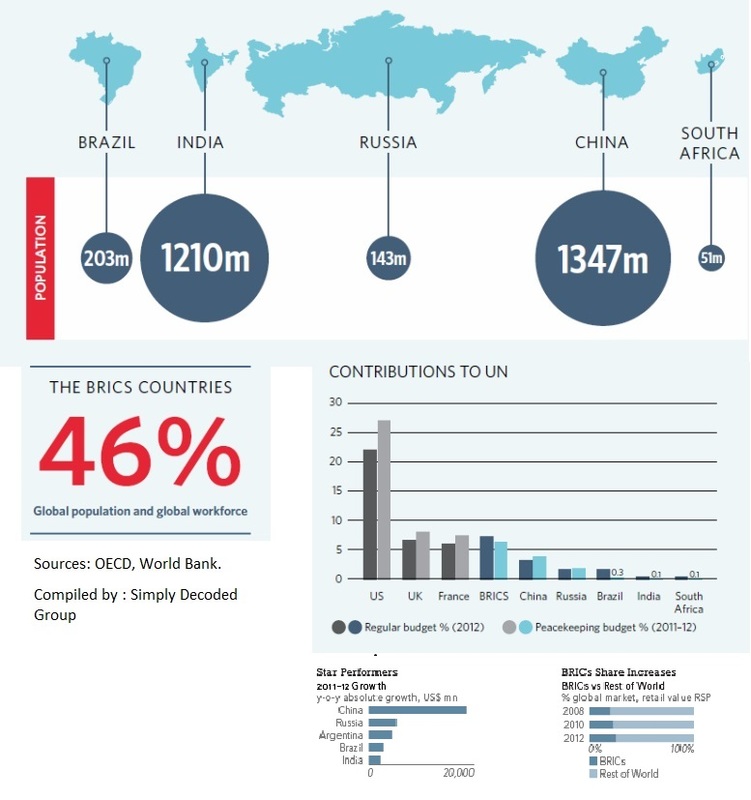

What will the near future bring to the European economy when BRICS takes its first steps into the economic world aiming to create a new world bank?

Well, the fact that the Eurozone holds many of its Euro Partners by the hand in attempt to lead them towards economic recovery is well and good, as long as many of these EU countries like Greece have n other choice, but now there is another choice and its called BRICS

Well, the fact that the Eurozone holds many of its Euro Partners by the hand in attempt to lead them towards economic recovery is well and good, as long as many of these EU countries like Greece have n other choice, but now there is another choice and its called BRICS

|

The next 6 months will be interesting to see how things unfold and how Europe & USA may need to rethink their strongholds especially now that UK has signed up to BRICS, has the UK seen the reality and strength of BRICS and is playing it safe and prefers to sit in the middle of the fence rather than take sides? or does the UK want to shift away from German and USA global economic control, if so why?

Like most things that aim towards change and restructuring, we would expect a great deal of upheaval which I am sure will slowly unfold to reveal the future of and stability of the USA and European economy When over 80% of the funding to the UN to aid refugees globally comes from the European Union, then we cant help wonder how BRICS will effect that or improve matters Exciting or Worrying times ahead which we cannot afford to ignore |